The biggest blocker for many people looking to improve their home isn't what their extension should look like, it's how to finance the project from start to completion.

From the simple to the extravagant, your home-improvement project will need to be funded, unless you want to stare at the unfinished remains of your dream kitchen and an empty bank account.

Avoid potential financial pitfalls by reminding yourself that any home improvement is an investment in your property. When all is said and done, your extension should significantly add to the value of your home.

We're here to cover everything you need to know to successfully finance your next home-improvement project - and if you're looking to buy some bricks at great prices to get you started on the right track, click the button below....

Request a quoteSet your budget

Unless money isn't a concern for you, setting a budget has to be priority number one. This ensures you can complete your project while avoiding any unplanned surprises along the way.

Start by framing the goal of your improvement project - then boil it down to one or two very specific (and achievable) goals. Do you want more space to entertain people or a spare bedroom for growing a family? Are you extending your kitchen for more counter space or remodelling a bathroom for a new hot tub? Is adding that sauna really necessary?

Next, take your large-scale goals and focus on the fine details. Do you want tiles or lino? Carpet or hardwood floors? Should you go for marble countertops or quartz? Or do you want everything to be made from recycled materials?

By selecting what you want to use before the project begins, your budget will be much more accurate and your contractor will be able to provide a precise quotation.

Start by framing the goal of your improvement project - then boil it down to one or two very specific (and achievable) goals

Compare contractors

To compare the quality and cost of trades, start by asking for a quote rather than an estimate. Try to obtain at least three different quotes for your project to determine the best option. When you've found the best quote, ask the contractor for a detailed outline of the entire project and its associated costs - known in the trade as a 'hard quote'. You may have to pay for this, depending on your contractor.

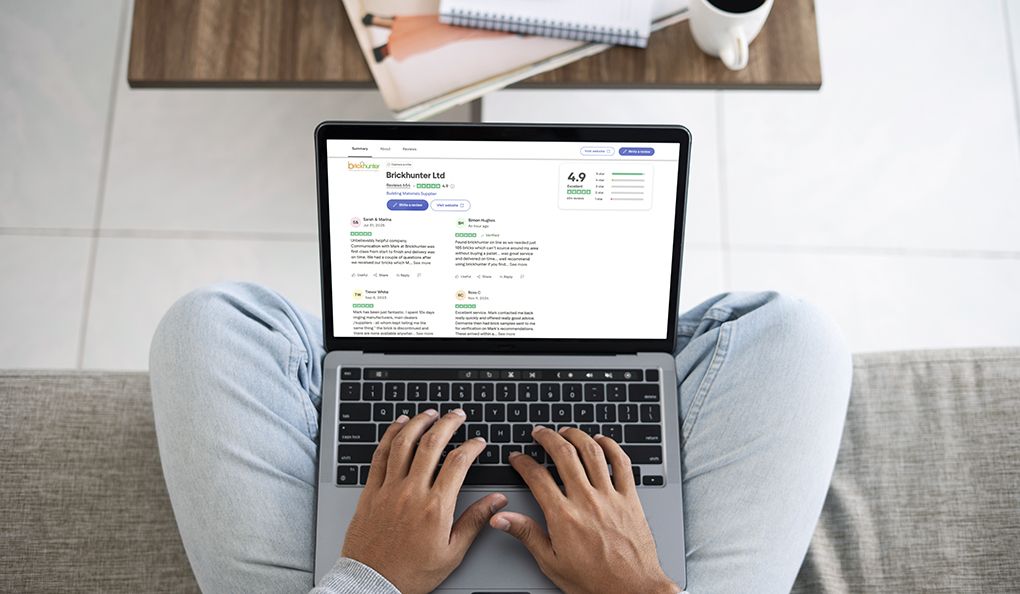

Finally, do a little legwork on the internet or around town to find reviews of individual contractors. The time and cost of any home-improvement project is nothing to sneeze at, so it doesn't hurt to find reviews or comments regarding your potential contractor.

When in doubt, nothing beats the opinion of someone you know that has hired a contractor in the past.

Choose your financing

There are right ways and wrong ways to go about financing an extension. The best way is to use your savings (if you have any!) to pay for your project, rather than borrowing from a bank. In a perfect world, we'd pay for everything with cash. But the majority of us have to face the reality of financing our project: credit.

Here are a few ways to borrow money for your home-improvement project:

⦿ Bank loan A secured loan allows you to borrow a large amount of money at once (usually more than £10,000). The lender usually loans the money against your home. Secured loans are considered a risk because the lender can repossess your house if you can't make the repayments. As a result, secured loans have a cheaper interest rate than unsecured loans, which don't use your home as collateral. This could be used to build a conservatory or add an extension to your home.

⦿ Home Equity Line of Credit (HELOC) Like a secured loan, a HELOC uses home equity as collateral, but provides a revolving line of credit rather than a large lump sum. It's similar to a credit card: a specific amount of money is available to use, based on the equity of your home. You make monthly payments and can continue to make charges, as long as you have credit available.

⦿ Contractor loan Some home contractors provide loans using a third-party lender. You might be able to arrange an interest-free period to make repayments as well. Just be careful not to lose the right to withhold payments if you're not satisfied with the work a contractor has done. When researching your contractor, be sure to ask previous clients about any financial issues they encountered.

⦿ Credit card This route is suitable for small-scale projects and improvements, such as building a brick wall in your yard. By opening a new credit card with 0% interest, you can purchase a manageable extension and make payments before the interest-free introductory period expires.

Look to the future

The re-sale value of your home after you've installed an extension is worth considering - especially if you think you'll sell your home in a few years. The potential return on investment could pay for the project itself, giving you a win-win scenario where you get to enjoy your new extension while reaping the financial benefits later on down the line.

It's worth noting that some improvements add more to the value of your home than others. In general, bathroom remodels increase the value of a home more than most other projects. Adding a master suite or backyard patio can significantly contribute to the value of your property as well.

Top tips!

Save more money on your home-improvement project with a few cost-cutting techniques:

⦿ Don't add anything you didn't budget for. It might be tempting to change materials halfway through the project or add a handful of small improvements, but any additional requests will cost money and require more labour. Knowing how many bricks you need for your build is a great place to start! Stick to your budget for now - you can make those additions after the project is finished.

⦿ Try to DIY smaller tasks. For example, you can paint a room after construction is complete or deconstruct a room by removing tiles or carpet before construction begins.

⦿ Select low-cost materials. You can save a lot of money by choosing the right materials. For example, installing a slate roof is very expensive (£15,000) compared to a composite roof (£4,000+). Even inexpensive materials can make for an attractive new bathroom, kitchen, or lounge.

We're here for you

Once you've secured your financing, it's time to get going - and your bricks are a great place to start!

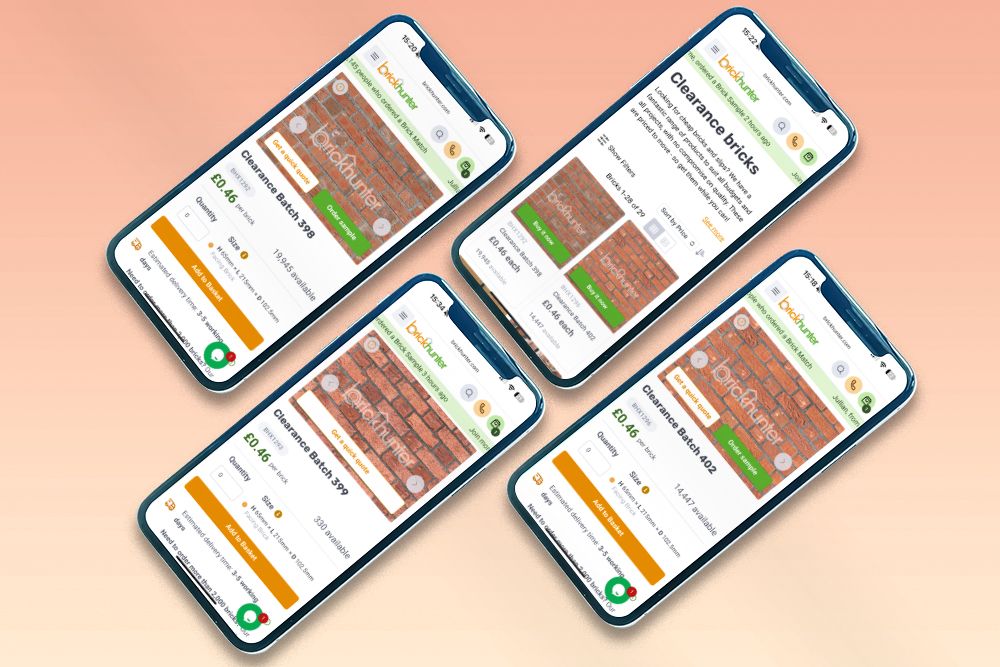

If you need help choosing the right type of brick for your project, our free Brick Selection service could be just what you need. Or if you'd prefer to browse bricks for yourself, we have more than 3,600 options to choose from - with fantastic cheap and reclaimed lines - in our Brick Library!

Plus, our expert Brick Advisors are standing by to help you figure out how many bricks you'll need to buy for your project, then source them and find you the best price - we'll even arrange delivery too.